The Textual Dimensions of Anglo-Durrani State Formation

1Abd al-Rahman relied on three categories of accountants, collectors, and revenue officials to execute his rapacious commercial tendencies at all levels and in all sectors of the Afghan economy. The power of these groups of state financial operatives was decidedly textual. At the highest level, individuals known as diwans presided over the central state account books. Those responsible for provincial revenue records were usually termed sarishtadars. This is not an absolute distinction as diwans were also active in the provinces and sarishtadars were found in Kabul. Regarding the social origin of these institutional categories, diwan appears as a title reserved almost exclusively for Hindus, but Hindus often received the sarishtadar label. However, this, too, is a blurred rather than clear division because a variety of Muslim groups were represented among the sarishtadars. Hindus could circulate between the kinds of state fiscal service designated by the two terms, while Muslims do not figure into the diwan category. Diwans and sarishtadars can be considered the central state and provincial revenue officers.

2Compared to diwans and sarishtadars, the mirza title is much broader and subsumes a wider variety of individuals who filled financial and textual niches within and outside of Durrani government service. Mirzas were patronized by a variety of government officials and local elites. There were no Hindu mirzas. Among the various Muslim groups found in this cosmopolitan frontier setting, the Qizilbash, an ethnically Turkic group of Shia Muslims who spoke Persian and were brought to Kabul by Nadir Shah Afshar, were noted as serving as mirzas for "every man of rank."1 Mirzas were the most numerous of the Durrani state's financial operatives at all levels of government. They were the rank-and-file of the accountant corps and performed the majority of the financial audits and investigations into the offices and officers comprising the Durrani state bureaucracy. They could investigate diwans, sarishtadars, and members of their own constituency. The mirzas handled the majority of smaller, everyday, and ordinary bureaucratic and clerical tasks, but they could also be assigned to delicate and important matters by Abd al-Rahman or other superiors.2 The mirza label connotes generic literacy because literacy could be either numerical or narrative. To be designated as a mirza one had to be functionally literate in the accounting or scribal sense of the term, or both. The position of secretary may best capture the written-word component of the mirza title, and accountant is perhaps the most appropriate way to conceptualize the numeric-service aspect of their duties. The labels bookkeeper and clerk apply well to mirzas whose duties subsumed both forms of literacy.

3Mirzas were the primary executioners of Abd al-Rahman's aggressive fiscal policies, but diwans and sarishtadars were also prominent and active in the area of fiscal audits.3 The three groups shared the abilities to create, interpret, and manipulate financial letters and account books, and as a result these revenue functionaries wielded enormous power over the merchant class, state bureaucrats and officials, and each other in late nineteenth-century Afghanistan. Their opinions, decisions, and judgments almost invariably resulted in revenue gains for the state, and once rendered, could only be challenged or revoked in the context of another larger and more lucrative case that would have been even more difficult to appeal. Once a mirza or another auditor was assigned to a targeted person or office an outcome favorable to the state was essentially predetermined, only the amount of the state's bounty and the means of compensation or collection remained to be determined.4

4It was not uncommon for targets of audits to be killed, and many of those who survived had been imprisoned and physically tortured. A large number of those audited were financially ruined and left as economic pariahs on their family, other associates, and neighbors whose resources also became vulnerable to state confiscation through textual means. In a similar vein, when diwans, sarishtadars, and mirzas replaced one another, accusations of past fraudulent activity regularly ensued. Factionalism was pronounced within and among each of the three groups of state revenue functionaries. The divisions found in and between the diwan, sarishtadar, and mirza categories were often created and perpetuated by the individuals and alliances operating in the political realm, i.e., among the officials and office-holders who were both the instigators and targets of the audits. During Abd al-Rahman's reign nobody in Afghanistan, including deceased officials and those serving in the religious establishment, was immune from the kind of textual terror he and other political elites wielded through their ability to unleash any one of a number of state-contracted auditors.5

5The textual dimensions of the nineteenth-century Afghan economy were evident in a number of areas beyond generic auditing, including in the scheme of prices used in private bankers' and the state's account books. There were three types of prices associated with different but overlapping sectors of the economy, namely, retail prices, prices fixed by bankers and moneylenders, and government prices.6 Ordinary consumers could be affected by all three price forms. For example, fruit producers experienced retail pricing in rural bazaars frequented to fulfill household and various personal consumption needs, and encountered bankers' and government prices at production sites, especially during harvests. But more important for our purposes, the common fruit producer was likely indebted to one or more members of the groups of brokers and bankers who financed the production of that commodity group and whose resources were heavily implicated in the given locality. As demonstrated in Chapter 1, it became increasingly common for brokers of fruit and other commodities to become government revenue farmers and as a result function as state tax collectors in the localities associated with the given commodity.7

6The typical scenario of a common fruit producer who was indebted to a banker, broker, or any other provider of credit including the state which garnered its revenue in the form of either produce or a form of "money," reveals at least two possible realms where those circumstances were textualized. The first set of texts that subordinated the average debtor to a creditor or group of the same were documents used by local Hindki bankers who extended various forms of credit to ordinary producers and the state. The Hindkis were themselves a diverse group whose accounting techniques remain largely unknown. The various forms of bookkeeping competence and literacy necessary to manage the active and purposefully open-ended accounts may not have been mutually intelligible among all the various groups of Hindki bankers.8 It is necessary to again mention that Hindki bankers and creditors could serve the Durrani government as revenue farmers or in a number of other capacities. Irrespective of that important possibility, the state tax collectors used a form of pricing and set of accounting practices that were probably related but certainly distinct from those employed by the Hindki banking communities in Afghanistan.

7Government prices and the form of pricing employed by local bankers were set for bookkeeping purposes. They were not equivalent, although both types of prices existed as functions of account management. Durrani government and Hindki bankers' prices represent monies of account and not hard cash.9 Each signifies a textual or book money that did not have an independent tangible existence apart from government and banking account records. Whether for the state or for the bankers, book-money pricing was based on unique and imaginary units of measurement. There is very little data to work from regarding the records maintained by Hindki bankers and firms such as the Shikarpuris in Afghanistan. However, archival and published sources indicate the form of book money used in the Afghan state account books was known as the Kabuli kham or raw rupee. A document generated by the second British occupation of Kabul and eastern Afghanistan refers to the kham rupee as "merely one of account; it bears no tangible existence." 10 The kham rupee was based on but distinguished from the ordinary or "real" rupee known as the Kabuli pukhta rupee, the ripe or cooked rupee.

8Braudel's argument that book-money prices represent a form of temporary credit that is convertible into real money when an account was settled through a final payment of some sort is useful here.11 Accepting that premise, the significance of government and bankers' price schemes were that they revolved around credit, a form of money theoretically distinct from cash. The textual course of any private or state-sponsored credit cycle was basically unknown to ordinary debtors, but it was in the financial documents of the firms and the state that the prevalence of debt characterizing Afghan society was most consequentially reflected and maximized.

9It is important to recognize the lack of data concerning the accountants within the Hindki community, and how that absence of information instills a high degree of conjecture about their fiscal practices and career histories. However, based on the circulation of bureaucratic knowledge in other state contexts and the patronage patterns of mirzas in Afghanistan specifically, it is reasonable to postulate that at least some Hindki accountants rotated their services between private businesses and firms, and that their knowledge and skills regarding textual debt management, however rudimentary or refined, were relatively rare, income-generating, and transferable.12 There is another significant and necessarily speculative area of inquiry regarding the personnel movement or bureaucratic demography of the accountants working among the Hindkis in Afghanistan during Abd al-Rahman's reign. It deals with the question of whether the kinds of textual literacy necessary to function as an accountant for a Shikarpuri or Peshawri firm would have sufficiently enabled those with such knowledge and skills to function as a diwan or sarishtadar or mirza for the Durrani state. The question as phrased begets an inverse line of inquiry about employment or contractual movement in the opposite direction, that is, from the state bureaucracy to the private sector. If such cross-sectoral employment migration existed, it begs a number of other queries about the circulation of debt among firms and between them and the state, and about the origin and available labor pool for the diwan and sarishtadar institutions in the Afghan state fiscal structure.

10Abd al-Rahman's reformation of the fiscal infrastructure of the Durrani state involved more than a just a greatly increased reliance on audits conducted by a diverse and growing body of accountants and financial operatives. The lack of data prohibits a definitive assessment as to the statistical expansion of the various types of state auditors during Abd al-Rahman's reign, but a certain swelling of their ranks did occur. However, any increase in the sheer number of bureaucratic personnel is less significant than the greatly expanded scope of their collective textual authority and reach. Abd al-Rahman offered clear opinions on the state account books in his autobiography.13 He describes the poor state of the state financial records as he encountered them on his accession, and describes his innovative approach to solving the problem as he viewed it.

11Abd al-Rahman claims to have completely revised state financial record keeping practices and the texts produced by and defining such activity. The new bureaucrats, and their practices and texts, had an interactive relationship that fostered a new type of fluidity within the fiscal infrastructure of the Durrani polity. Abd al-Rahman claimed to have heightened bureaucratic efficiency because he solved the problem of pandemic graft and corruption by government office-holders who could formerly very easily manipulate their office finances for personal aggrandizement. However, for merchants, officials, and society-at-large the elimination of one type of text-based financial corruption brought another. Abd al-Rahman's textual reforms resulted in another version of widespread economic malaise, one with a coercive literati using innovative state documents and records to mulct merchants, extort office holders, and extract inordinate amounts of resources from the general population. In essence, the Durrani government's reliance on documentary ambiguity was revised in favor of the state's commitment to textual specificity. In Abd al-Rahman's words:

The old system of keeping offices in Afghanistan was, that there were no books for entering any of the accounts, small sheets of paper, about eight inches long and six inches wide, being used. Each of these sheets was called a fard (single leaf). These small pieces of paper were half filled by writing at the top, the name of the office, the year and date, and various unnecessary things, and the other half contained three or four words, then the sheet was full. What could have been entered in two sheets of a book took 100 of these small scraps of paper. In consequence, when a certain item was required for reference, in was necessary to go through thousands of these scraps, which was a very great waste of time. The worst fault of all was that any official or accountant who had embezzled Government money, could easily take a few sheets or one sheet away, and either write another or tear them up all together. I have introduced books, and on the first page the numbers of each page or sheet are written and sealed with my seal to the binding of the book, so that no one can take a sheet out of the book without breaking the seal. At first some people played tricks and tore out some sheets, for which their fingers were cut! Now every one, at the time of taking a book, writes on the first page with his own hands that he promises to have his hands cut off if he cuts the book!14

12In addition to his reliance on diwans, sarishtadars, and mirzas, who were personally responsible for these refashioned account books, Abd al-Rahman used other means to exert his textual authority over a largely illiterate populace. Another example of textual oppression concerns the non-recognition of documents issued under previous regimes that were retained by merchants precisely to validate past financial action. In this regard, it appears Abd al-Rahman used rulings issued by his panchayat, or commercial council, a body appointed to legitimize his own and other officials' commercial conduct, to invalidate receipts and transform other exonerating evidence into incriminating conduct.15 If practiced on a wide scale, discounting the validity of receipts would result in mercantile flight and devastate the economy where it occurred, and this appears to have happened in Afghanistan during Abd al-Rahman's reign.

13Abd al-Rahman used paper texts as pillars of his domestic intelligence architecture. For example, petition boxes were kept under secret surveillance to learn the identities of those depositing supposedly anonymous opinions.16 In another expression of texts as intelligence, a clarified butter-seller or ghi furosh in Qandahar who was severely indebted to his clients began to call on the government mirza stationed at the local granary to pen unsolicited intelligence reports directly to Abd al-Rahman. These voluntary textual offerings were apparently received favorably, as not only did local creditors ease their demands on this wily character, others actually began to present cash gifts to him in hopes of receiving favorable mention in his uniquely inspired and profitable intelligence reports.17

14There were direct and indirect intelligence benefits from Abd al-Rahman's increasing dependence on the written word generally and state texts in particular, but the revenue function of these documents deserves particular notice. In his own hierarchical ordering of the sources of Durrani state income, Abd al-Rahman mentions the Post Office as a source of funds after revenue generated from the "land and fruit trees, and duties on export and import and various customs money."18 The post office produced a substantial income for the state from the "sale of various kinds of stamps for promissory notes, forms of contracts, bills of exchange, etc."19 Elsewhere in his autobiography Abd al-Rahman opines even more explicitly about the income-generating aspect of his new textual regimen:

I introduced hundreds of different stamps and forms of paper for contracts, deeds, promissory notes, marriage settlements, passports, which bring in revenue, and were never even heard of before my time in Afghanistan.20

15Abd al-Rahman's textual interventions were felt in all regions and sectors of the Afghan economy and among all social strata. For example, to revise the local brokerage practices in Qandahar from Kabul, Abd al-Rahman armed a Hindu named Jita with a written pamphlet outlining the new state policy on this important commercial service and dispatched him to the former Durrani capital city. Jita carried a kind of text referred to as a dastur al-amal or regulation on the subject of brokerage that was signed by Abd al-Rahman.21 Even the tribal maliks or chiefs in Qandahar province, the majority of whom were Durranis and therefore ethnic affiliates and political favorites of Abd al-Rahman, were subjected to the new forms of state-paper oppression. Formerly, district and subdistrict administrators for the Durrani government would disburse between four and five rupees as annual cash stipends directly to certain local chiefs. In this regard, Abd al-Rahman's textual innovations on these allowances triggered spatial movements by these local Durrani chiefs and contributed to their being monitored by and accessible to the central Durrani state. For their allowances Abd al-Rahman made the Durrani maliks come to Qandahar, and some maliks had to travel six or seven days journey to that city. In Qandahar, checks were issued to them by an accountant or secretary. Each malik then had to carry the new state paper money back to the given locality and present it to the government administrator for the check to be cashed on the district's or subdistrict's account.22 A final expression of the revenue-earning potential of state-issued paper also comes from Qandahar where to collect the recently imposed marriage tax Abd al-Rahman distributed stamped forms to qazis or religious court judges on which marriage contracts were to be written. The fee of 10 rupees per marriage, or more specifically per new marriage contract, was decreed to be collected from all those who were married in Qandahar during the past three years.23

16Abd al-Rahman's textual policies and practices were primary catalysts of the social transformations that occurred in Afghanistan during his reign. Through a heightened reliance on auditors and an increasing production and dissemination of revenue-generating texts, Abd al-Rahman carved out a prominent niche for documentation in his state formation agenda. The wide array of state texts produced by Abd al-Rahman had profound implications on relations between the Durrani government and Afghan society. The technology most implicated in these developments was that of machine printing. Abd al-Rahman appears to have imported printing press machinery to Kabul sometime between 1885 and 1890. His own comments on these powerful devices demonstrate that the expertise and knowledge required to use the new European machine technology was also imported:

Before my accession to the throne there were no typewriting or printing press throughout the whole dominion of Afghanistan . . . (now) thousands of copies of various books furnishing information on various subjects, forms of papers, stamps, promissory notes, etc., are printed and published by the Kabul Press . . . the man who deserves the greatest praise for opening the press at Kabul was the late Munshi Abdul Razak of Delhi; he died of fever, but the printing and press work are being carried on by many Kabuli men taught by him . . .24

Landowners and Laborers

Landowners and Laborers

|

Surgeons and Physicians

Surgeons and Physicians

|

Bankers

Bankers

|

Execution

Execution

|

Man Cage Distant View

Man Cage Distant View

|

Man Cage Close-Up View

Man Cage Close-Up View

|

Post Office

Post Office

|

Coins

Coins

|

Guthrie

Guthrie

|

State Monopolization of the Export Fruit Trade

17The Durrani state intervened even more directly and farther into fruit production and marketing processes. At the end of the nineteenth century the colonially appointed Durrani Amir Abd al-Rahman (ruled 1880–1901) monopolized the fruit export trade by inserting his own state agents as the sole brokers of the commercial trafficking in this important commodity group. The tactic of using state brokers to monopolize the export trade in fruit and other commodity groups was a primary element of Abd al-Rahman's state formation agenda.25 The fruit monopoly resulted in the re-routing and refinancing of a significant portion of this abundant commodity that was harvested for export. The terms of the monopoly also reflect Abd al-Rahman's intention to displace an existing community of South Asian brokers whose resources and investments in the fruit trade were targeted for advancement during the first British occupation. Forty years later, and after a second Anglo-Afghan war (1878–80) concluded by Abd al-Rahman's accession, Indian merchant capital appears visibly if not dominant in the harvesting and marketing processes associated with the export of eastern Afghan fruit.26 However, by the end of his reign a large number of Indian brokers, bankers and traders had left Kabul and re-routed and reallocated their resources to avoid the city. They were supplanted by a series of alterations to the export and transit-trade activities hinged on the burgeoning capital city.27 Abd al-Rahman's commercial policies and practices regarding the movement of fruit and other goods ultimately restricted Afghanistan's entry into a maturing global economy.

18The first British occupation of Kabul and eastern Afghanistan unraveled during the fruit-marketing season in the fall 1841. The expulsion of the British resulted in a hiatus in the supply of data generated by colonial officials about and from within this region. For roughly forty years after the first war it is difficult to determine how much or what portions of Trevor's budgetary and revenue reform package survived in places like Koh Daman, Istalif, and Arghandeh.28 The second Anglo-Afghan war renewed the flow of information about social and economic conditions in eastern Afghanistan.29 During the reign of Abd al Rahman colonial officials generated a prodigious supply of data about the precipitously declining state of trade through Afghanistan. British documents relating to Abd al-Rahman's trading monopolies reveal another dimension to the relationship between revenue farming, commercial brokerage, and the Durrani state's involvement in the export of fruit from Kabul and its vicinity.30

19When compared to the experimental period, political relations between Afghanistan and India were markedly stabilized by the British appointment of Abd al-Rahman to the Durrani throne in Kabul in June of 1880, an event that signaled the end of the second Anglo-Afghan war. On the economic front, the scheduled British disbursement of cash subsidies to Abd al-Rahman for the duration of his reign defined and regulated interaction between the two unequal state powers. The term routinization is therefore used here to characterize Anglo-Afghan relations during last two decades of the nineteenth century, but it is important to note that the notion of a subsidy-based routine applies to the realm of state-to-state interaction. When compared to his predecessors, Abd al-Rahman's relationship to the community of interregional traders and brokers whom linked his polity to those surrounding it, particularly to British India, were exceptional, unexpected and decidedly non-routine in a number of important respects.

20Abd al-Rahman's monopolization of the export fruit trade was executed by farming out the right collect the "brokerage and weighmen's fees" of the fruit that "Afghans and others export from Kabul to Peshawar."31 The privilege to collect such fees was leased for one year at a time. The farmer or leaseholder agreed to pay Abd al-Rahman Rs. 1,20,000 within one year from the date of the deed of partnership.32 Furthermore, the leaseholder was responsible for another Rs. 50,000 of Abd al-Rahman's money that was to be advanced to the carriers of the fruit when they reentered Afghanistan in the spring. The Afghan tribal traders, known locally as kuchis, advanced that cash to cultivators as loans that secured future claims on their fall harvest (see later). After the Rs. 1,20,000 and the Rs. 50,000 were repaid Abd al-Rahman and the fruit farmer agreed to split any further profits evenly, and both parties certainly anticipated such opportunities for additional revenue gains.

21The first expression of this monopoly arrangement came in 1892 at the beginning of the annual fall exodus of Afghan traders, merchants, and laborers to India for the winter season. On September 4, 1892, the fruit monopoly era began with Abd al-Rahman issuing a deed of partnership in the export fruit trade to Nur Muhammad, a Taraki Pashtun from the Jalalabad district. The monopoly arrangement covered an array of dried and fresh fruits, certain nuts, assorted other foodstuffs, and two dyes. The list included fresh grapes packed in boxes, all kinds of raisins (long, small, red, green, etc.), two types of melons (watermelons and sarda or musk melons), seedless pomegranates and pomegranates with seeds, dried apricots, kernels of apricots, dried kernels of apricots, apples, pears, dried curds, ghi, gram, dried chick peas, madder, pine nuts, dried roses, tobacco, zira (a seed used in the cooking of rice), an edible vegetable garnish known as samaruk, asafetida, and a dye for silk made out of the pistachio tree, buz ganj.33

22The monopoly was designed to induce a certain routing for the kuchi carriers of the specified fruits, and so on. The kuchis were the primary carriers of the abundant supplies of fruit from the Kabul environs to the vast consumer markets of North India. Most of the kuchis entered the subcontinent by way of Ghazni, the Gomal Pass, and Dera Ismail Khan, although other routes were also used by commercial caravans carrying Afghan fruit. The fruit monopoly had the affect of shifting the fruit traffic north from the Gomal route to the Khaibar mountain passage linking Kabul and Peshawar. In order to encourage the kuchis to use the Khaibar route Abd al-Rahman ordered security deposits to be collected from them, preferably at Dakka, the last Durrani state transit-trade post in the Khaibar corridor. While Dakka was the prescribed site for security deposit collection, such fees could also be paid along any other route in eastern Afghanistan where government toll posts existed.34 To recover their security deposits, the kuchis first had to take their loads to the fruit monopoly leaseholder Nur Muhammad in Peshawar who directed them to a subcontracted broker (Jit Mal, see later) who signed their security deposit receipts. The second step toward recouping their security deposits compelled the kuchis to re-enter Afghanistan in the spring via the Khaibar wherein at Dakka they could present their signed receipts for reimbursement.35

23Returning to the commercial activities occurring in the fall season, on arrival in Peshawar laden with their fruit cargo, the kuchis contacted Nur Muhammad who directed them to a subcontracted broker and the weighing facilities provided by that broker. In Peshawar an individual named Jit Mal provided brokerage services. Jit Mal's brother was responsible for weighing, and together the siblings presumably influenced the decision about additional packaging, short-term storage facilities and the subsequent transport of the greater portion of the fruit out of Peshawar. According to petitions filed with the British Indian Government the rates Jit Mal and his brother charged the kuchis for handling their fruit were double and in some cases triple the amounts charged for similar services provided by the remaining brokers and weighmen in Peshawar.36 Furthermore, Jit Mal was instructed to inform Nur Muhammad of any kuchis carrying fruit who evaded the monopoly. The names of kuchis caught without the proper paperwork were forwarded to Abd al-Rahman who required little instigation and seems to have thrived on such contrived opportunities to inflict retributive confiscation and imprisonment, or worse, on those disobeying his directives.

24A community of about thirty brokers and weighmen of Afghan fruit in Peshawar were cut out of the Afghan fruit export market by the Durrani state-appointed monopolist Nur Muhammad and his partners Jit Mal and Jit Mal's brother. The disenfranchised Peshawri brokers and weighmen petitioned the British government. They claimed Abd al-Rahman's monopoly constituted an unfair business practice predicated on the very real threat of coercion faced by the kuchis in Afghanistan should they be caught avoiding Jit Mal and dispensing their fruit on the open market at the best available price. The outed middlemen argued further that the kuchis were now paying exorbitant fees to the monopolist that would ultimately generate inaccessible prices for the Afghan fruits consumed by the popular masses throughout northern India. The circumvented brokers and weighmen envisioned the declining fruit trade would also be reflected in diminishing Peshawar municipal octroi receipts. Colonial officials concurred with the Peshawri brokers' assessment of the Afghan fruit monopoly's detrimental effect on their community, and reiterated an anticipated imposition on the popular consumer masses in North India:

It will be readily seen what a serious effect so extensive a monopoly of what are almost necessaries of life will have not only upon the business of the local trade, but on the people generally . . . (the monopolized items) are articles of daily consumption by even the poorest classes of Northern British India . . . (that) can be obtained only from Afghanistan, ghi and tobacco excepted . . . There is practically no limit to the point up to which the monopolist can drive up prices thereby causing much hardship and discontent.37

25British officials researched the current market rates for brokerage and weighing services and determined the monopolist Nur Muhammad and his subcontracted broker Jit Mal charged the kuchis artificially high prices for handling the exported Afghan fruit in Peshawar. As a result, some colonial bureaucrats opined that in practice Abd al-Rahman's fruit monopoly was actually a new form of Durrani state tax that was being collected in India. Other British Indian officials argued that:

What he (Abd al-Rahman) is doing, namely, giving advances to growers and dealers and appointing agents in whose hands the whole trade is being concentrated, is very much like that is done in this country by large exporting firms who keep their agents at all large places, and through them give advances to cultivators and dealers, and thus concentrate the trade in grain and seeds in their own hands . . . He also knows probably about our opium monopoly, which resembles this one he has taken up in the way of agents, advances, and so forth.38

26Despite the variety of interpretations of Abd al-Rahman's fruit monopoly, there was colonial bureaucratic unanimity regarding the difference between it and the commercial monopolies or monopoly-like arrangements executed by the large exporting firms of India and the colonial state itself regarding opium and other commodities. For colonial bureaucrats the distinction lay in the degree of coercion employed. About monopoly practices generally British officials felt that in India "there is no compulsion in the matter whereas he (Abd al-Rahman) compels." Although this statement lakes nuance and makes too bold a contrast, Abd al-Rahman's penchant for mulcting the commercial classes in Afghanistan was well known to British officials. British officials were rightly convinced that whomever Nur Muhammad mentioned to Abd al-Rahman as evading the monopoly would be financially ruined through confiscations and fines (as could people immediately related and distantly connected to the original "violator").

27During the first season of the monopoly's existence the brokers and weighmen in Peshawar who were cut out of the Afghan fruit trade repeatedly petitioned Abd al-Rahman and the British Government about their plight. On December 14, 1892, Abd al-Rahman wrote to the brokers directly in response their collective claims against Nur Muhammad and the alleged unfair business practices associated with him:

Nur Muhammad is a monopolist of fruit exported from this territory to Peshawar, on the same system as the monopolies which commonly exist in all cities of Hindustan. . . . Nur Muhammad, who has obtained the contract for the fruit of Afghanistan, buys and sells this fruit with the consent of the fruit owners and at the price of the day, and this matter is no concern of yours.39

28In his correspondence with the British about the matter, Abd al-Rahman justified the fruit monopoly as defending the kuchis' interests.40 He claimed the kuchis were having their justly earned profits siphoned by the brokers and weighmen of Peshawar. Abd al-Rahman felt that as owners of the Afghan fruit the kuchis, who were his subjects, should not have their resources diminished at the expense of the Peshawri brokers and weighmen who were British Indian subjects.41 However, at the same time, Abd al-Rahman and his own officials corresponded with one another in full recognition that the kuchis did not want to partake in the fruit trade via the terms of the new state monopoly. Durrani officials recognized that "unregistered" fruit from Kabul and its surroundings continued to arrive in Peshawar. Abd al-Rahman and his officials were completely aware that large numbers of kuchis and other groups of Afghan merchants regularly evaded the monopoly's system of surveillance based on a Khaibar routing focused on Dakka and security deposit receipts countersigned by a subcontracted Sikh broker in Peshawar. In this regard, the kuchis frequenting the Kohat Pass and Kohat city, and communities of carriers generally known as pawindahs who were associated with Gomal Pass and Dera Ismail Khan, such as the Lohanis and Sulaiman Khel Ghalzis, received special attention as monopoly resistors from Durrani state officials.42

29The British Indian colonial state viewed the kuchis as vulnerable to Abd al-Rahman's fruit monopoly, but because they were Durrani state subjects and there was no apparent physical threat to them in India, the British did little to alter either the Durrani state's execution of the monopoly or the kuchis' evasion of it. At least one colonial officer advocated deducting the amount lost by the Peshawri fruit brokers and weighmen from the subsidy the British provided to Abd al-Rahman.43 However, the opposite occurred only a year after the fruit monopoly was instituted. The Durand agreement of 1893 resulted in the subsidy being increased 50 percent from Rs. 12,00,000 to Rs. 18,00,000 annually.44 From the British perspective the negative economic consequences of the fruit monopoly clearly paled in comparison to the political imperatives of the "Great Game" period. Colonial officials therefore allowed the fruit and other Durrani state monopolies to exist until Abd al-Rahman's death in 1901, which created the opportunity to once again reconfigure relations between colonial India and Afghanistan.

30The commodities monopolies were an integral part Abd al-Rahman's state formation agenda. The fruit monopoly was particularly significant as a vehicle for displacing South Asian merchant capital from local production routines in and around Kabul. The Rs. 50,000 advanced by Nur Muhammad to the kuchis was one of many steps Abd al-Rahman took to insert Durrani state resources into domestic cultivation processes in lieu of foreign merchant capital. The Afghan fruit monopoly documents indicate brokers in Peshawar had considerable resources invested in the local fruit cultivation schema in the vicinity of Kabul. The Peshawar brokers and weighmen depended on their relationships to kuchi carriers in order to distribute their capital investments in those localities.45 During the first season of the monopoly the British recognized the likelihood of ongoing exclusion of Indian merchants from the fruit revenue structure of the Kabul-centered Durrani state. Colonial officials understood the monopoly would cause the community of fruit handlers in Peshawar to loose the brokerage and weighing fees they earned from the kuchis. The British also recognized the prospect of the Peshawar brokers' ongoing exclusion from the production and marketing cycles associated with eastern Afghan fruit. Such sentiment is implicit in the following British opinion, generated less than a month after the monopoly's announcement, that the brokers were now:

. . . unable to recover the large sums of money which they have been in the habit of advancing to the fruit merchants on their way to Kabul every spring, and of recovering from them when they come back with their fresh supplies in the following autumn.46

31The establishment of the Durrani state fruit monopoly in the fall of 1892 transformed a number of social and economic relations in and around Kabul and throughout eastern Afghanistan, a few of which will be reviewed to close this section. In the first instance, the relationship between the kuchis and the Durrani state assumed new textual, material and spatial dimensions as a result of Abd al-Rahman's farming of the right to collect the brokerage and weighmen's fees associated with exported fruit. For the kuchi carriers, whether in adjustment to or avoidance of security deposits and signed receipts and/or the Dakka-centered Khaibar routing, the fruit monopoly reconfigured a number of everyday spatial and fiscal practices. The monopoly also engaged the kuchis as providers of Durrani state loans totaling Rs. 50,000 to fruit producers in localities surrounding Kabul. This action replaced the Peshawri brokers' investments in the same fruit-producing sites in eastern Afghanistan and highlights the important role of the cash advances in the overall monopoly package. Similar to the appointment of Nur Muhammad who subcontracted with Jit Mal, Abd al-Rahman's cash advances to the kuchis for local disbursement were designed to concentrate and circulate revenue from fruit production and marketing domestically, that is, with and within the Kabul-centered Durrani state. Before the monopoly the capital associated with Afghan fruit production and marketing processes was dispersed far into South and Central Asia and beyond through extensive commercial networks dominated by Indian bankers and traders and the resource consortiums they formed such as Shikarpuri family trading firms and mercantile houses. In addition to transforming relations between the Durrani state and the kuchi carriers, and between Kabul and villages surrounding the city, the fruit monopoly also affected the course of Durrani state formation by modifying Kabul's association with other major regional markets. The monopoly was one in a series of moves undertaken by Abd al-Rahman that amplified the direct market-to-market links between Kabul and Peshawar through the Khaibar Pass. Such an intensification of commercial interaction between those two cities and along that route drew resources away from the economic exchanges between Kabul and other domestic and foreign markets such as Ghazni, Qandahar, Mazar-i Sharif, Bukhara and Dera Ismail Khan, and diminished the significance of the routes linking those locales.

Sikh Festival

Sikh Festival

|

Sikh Merchant

Sikh Merchant

|

Khaibar View of Torkham

Khaibar View of Torkham

|

Torkham

Torkham

|

Tea Merchant

Tea Merchant

|

Commodity Monopoly Texts and the Qafilabashi

32This section deals with the impact some of the new Durrani state texts had on the Afghan nomads who migrated from Central to South Asia in the fall, and returned from Hindustan to Afghanistan, Khorasan, and Turkistan during the spring. These long-distance nomad traders carried primarily Afghan fruit to North India during the fall season. Fall season profits were invested in a wide variety of other articles purchased in India during the winter and transported "back" to and marketed in Afghanistan and Central Asia during the spring and summer. Abd al-Rahman used a number of novel receipts, vouchers, passes and certificates to implement his state monopoly of the lucrative export fruit trade. The nomadic traders who carried the large volumes of fruit from Kabul and its environs to Hindustan were especially hard hit by the documentary aspects of Abd al-Rahman's fruit monopoly. The new fruit monopoly texts compelled a Khaibar as opposed to a Gomal Pass routing and identified the nomads to the Durrani state transport official known as the qafilabashi who was based in Peshawar and superintended the movement of all goods destined for Kabul that were routed through the Khaibar. The qafilabashi worked with a munshi or secretary who was responsible for a register book known as a challan within which the amounts and kinds of commodities and their means of animal conveyance to Kabul were recorded and manipulated.

33In the fall of 1892, Abd al-Rahman leased the rights to collect the brokerage and weighmen's dues of all the Afghan fruit exported to India to Nur Muhammad Taraki.47 The colonially appointed and subsidized Durrani dynast used multiple texts to execute his revenue-farming arrangement that effectually served as a state monopoly of the export fruit trade from eastern Afghanistan to greater North India. The fruit monopoly significantly impacted the nomads in the realm of routing. Before the institution of the monopoly, the carriers of eastern Afghan fruit generally proceeded from Kabul south to Ghazni where they congregated for passage through eastern Ghalzi country to and through the Gomal Pass and on to Dera Ismail Khan. Dera Ismail Khan was the nomads' banking center and the point from which they disaggregated to pursue various market paths leading across the Hindustan plains and Himalayan foothills. Through the use of various state texts the fruit monopoly compelled a routing for the nomads that carried them due east from Kabul, ideally through Buthak, Gandamak, and Surkhpul, before reaching Jalalabad, from where they would enter the Khaibar Pass and present themselves at Dakka before exiting the pass and proceeding to Peshawar.48

34Nur Muhammad's contracted services as the fruit export monopolist allowed the Durrani state to extract additional taxes from the nomads while increasing its surveillance over their physical movements and fiscal practices and furthering its imposition on their human labor and other forms of commercial capital including animal resources. In the first instance, the Khaibar routing was induced in Kabul at the chabutara or customs house where the goods destined for India were itemized in a challan register book. At the Kabul customs house Nur Muhammad collected security deposits from the nomads for their goods that were henceforth considered Durrani state property. If security deposits could not be collected from the nomadic traders at the Kabul customs house, the nomads were expected to make their required deposits at one of the four aforementioned locations between Kabul and Dakka. In return for their deposits the nomads were given receipts issued by Nur Muhammad that they presented to Nur Muhammad's subcontracted broker and weighman in Peshawar, Jit Mall and his brother, respectively, who countersigned the receipts.

35During their spring migrations from India back to greater Central Asia, the Afghan nomads had the incentive and need to again use the Khaibar Pass. One reason for traversing this corridor during the spring was because only at Dakka in the Khaibar could the nomads present the their double-signed fruit security deposit receipts for reimbursement. The new forms of taxation and documentation associated with Abd al-Rahman's fruit monopoly were designed to route all nomads carrying fruit from Kabul to Peshawar through the Khaibar Pass. However, during the first year of the monopoly it became abundantly clear that many Afghan nomads were resisting through avoidance some of the important terms of the fruit monopoly including its higher taxes, new state paperwork, and prescribed routing. From Kabul the majority of Afghan nomads were accustomed to using routes to India south of the Khaibar, many of which led through eastern Ghalzi country, the Kohat and Gomal Passes, and converged on Dera Ismail Khan.

36In the late fall or early winter of 1892, an influential group of nomad traders, including representatives of Lohani, Sulaiman Khel Ghalzi, and Kharoti tribal groups, petitioned Abd al-Rahman about the fruit monopoly.49 These nomad traders claimed that the Khaibar routing caused them great inconvenience because their families accompanied the caravans and arrangements for their dependents, animals, and goods were traditionally made in the daman plains of the Indus River and the foothills ascending westerly into the Sulaiman mountain range. In late February or early March 1893, Abd al-Rahman responded to their plea by allowing them to avoid the Khaibar. However, the colonially appointed Durrani sovereign's apparent benevolence on this point was in fact countervailed because in the same letter he also announced the deputation of a mirza and two subcontracted agents of Nur Muhammad to collect arat or export commission fees from all nomads carrying Afghan fruit to India.50

37Muhammad Akbar Khan was one of the Afghans Abd al-Rahman authorized to function as a subagent of the fruit monopolist Nur Muhammad Taraki. In the fall of 1893, at the beginning of the second year of the fruit monopoly, Muhammad Akbar appeared in the main market of the town of Kohat with another form of Durrani state text authenticated by Abd al-Rahman's seal. Muhammad Akbar carried a parwana or order from Nur Muhammad written in Persian by a mirza Abd al-Rahman assigned to the case. Muhammad Akbar claimed the state document he wielded entitled him to collect the same export commission rates in Kohat as at Dakka or any of the other official toll posts between Kabul and Peshawar.51 Most of the Afghan nomads in Kohat had dispersed by the time Muhammad Akbar arrived, and most of those who remained and were found with fruit in their possession claimed insufficient resources to pay the required arat fees. These unsuccessfully evasive nomads were forced to sign vouchers, also a new documentary initiative, stating they would pay the export commission fees at Dakka on their return to Afghanistan the following spring. The kuchis in Kohat who avoided the Khaibar in the fall but could not avoid the fruit security deposit net returned to Afghanistan via the Khaibar and Dakka in the spring because their signatures on the export fee vouchers identified them to Abd al-Rahman who was sure to act on their "mutually agreed on" intention to "contribute to the welfare of the tribes and benefit of the khazana bait al-mal" or public treasury.

38Export fees were not the only form of state tax Muhammad Akbar realized from the Afghan nomad traders in Kohat through the application of Durrani state textual power. Salt, imported from India generally and Kohat in particular, was and remains an important commodity used and consumed by all classes of Afghan society. Abd al-Rahman monopolized the trade in a number of commodities, including local products, especially fruit, and imported goods such as salt.52 Pursuit of fruit-trade profits for the Durrani state brought Muhammad Akbar to Kohat, and while there he pursued the derivative issue of arat fees, but execution of the salt monopoly also received his attention during his stay in the city. Abd al-Rahman intended for Afghan nomads to purchase passes identifying them as participants in the Durrani state salt scheme, and while in Kohat Muhammad Akbar invoked government texts requiring the nomads to invest in the "public good" in this manner. The nomads were accountable for salt passes that were acquired at rates of Rs. 1.8 per camel load, Rs. .8 per mule or bullock, and Rs. .4 per donkey load.

39Similar to their view of the various taxes associated with the fruit monopoly that Durrani state officials collected from textually captive Afghan nomads in British India, colonial bureaucrats unanimously interpreted the activities associated with Abd al-Rahman's salt scheme as illegal extraterritorial taxation. British officials did little to support the nomads' redresses to the colonial courts that they were being oppressed and extorted by Abd al-Rahman while they pursued legitimate commerce and lawfully engaged Indian markets. The British did not effectively invoke the colonial state's umbrella of territorial and legal protection over the Afghan nomads, but some British Indian officials did recognize and sympathize with the legitimacy of the nomads' claims. Regarding a number of commercial issues including the Durrani state's collection of taxes from Afghan nomads in British India, colonial policy makers were restricted to one primary avenue of recourse. In response to the perceived commercial misconduct of Abd al-Rahman, the British chose only to manipulate the cash subsidy issued to their appointed and fiscally dependent Durrani sovereign in Kabul.

40According to the British, Abd al-Rahman's extraterritorial tax collection, especially when associated with his trading monopolies, was increasingly "demoralizing" to Indian traders. As a result, some of the Durrani state taxation practices in India were eventually reduced and eliminated. However, colonial officials conceded the legitimacy of many Durrani taxes and taxation activities, provided they were collected or conducted at Dakka in the Khaibar, which was one of many unique administrative arrangements of this strategically important mountain passage.53 Colonial officials also consented to the continued collection of one Durrani state tax in British India proper. Partly to monitor the flow of commercial traffic from India to Afghanistan, or more precisely, from Peshawar to Kabul through the heavily surveilled Khaibar, the British allowed Durrani state qafilabashi fees to be collected and recorded in Peshawar or at Jamrud.54

41The Peshawar qafilabashi or superintendent of caravans was the Durrani government official in Peshawar who received state commercial caravans, such as those carrying fruit, routed from Kabul and through the Khaibar in the fall. The qafilabashi was also responsible for the dispatch of Durrani state caravans from Peshawar to Kabul in the spring. The Peshawar qafilabashi determined the chronological order and size of caravans carrying commodities purchased in India that were destined for Durrani state consumption in Kabul, and the physical configuration of items within those caravans.55 The taxes collected by the qafilabashi, known as qafilabashi giri and rawangiri Kabul, were assessed on the animal of carriage, and for the most common transport animal along this route, the camel, the rate was Rs. 2. As we have seen, the textual terms of Abd al-Rahman's fruit monopoly resulted in his identification of many of the nomads who transported fruit from Afghanistan to India, all of whom owned their own camels. During the winter the fruit monopolist communicated with the qafilabashi who used security deposit records produced in the fall to conscript privately owned camels from Afghan nomads for Durrani state carriage purposes in the spring.56

42The nomads could pay their qafilabashi dues at that official's office in Peshawar city or at Jamrud before embarking on their springtime procession through the Khaibar to Kabul. No matter where they paid their fees, the nomads received a pass for their expenditure from the Peshawar qafilabashi that was necessary for them to be formally received by the darogha or British official stationed at Jamrud, the eastern "gate" of the Khaibar Pass.57 The nomads' textual, fiscal, and physical engagement of the Peshawar qafilabashi was ostensibly confined to the animals used to convey Durrani state property to Kabul. However, in practice the transactions between the nomads and the qafilabashi were not limited to transport animals carrying goods destined for Durrani state consumption. Abd al-Rahman ordered his Peshawar qafilabashi to collect arati or commission fees on all products the nomads brought to market in Kabul. In theory these commission fees were attached to products the nomads marketed independently of their textually coerced, state-contracted, Khaibar-centered carriage services. In factual terms the Peshawar qafilabashi monopolized the movement of commercial transport animals through the Khaibar toward Kabul. The qafilabashi's interest in and knowledge of those animals brought their cargo into his field of vision, which resulted in him charging the nomads Rs. 1 per camel load of commodities obtained with their own capital that they transported on their own behalf through the British-controlled Khaibar to market in Afghanistan and Central Asia. It is unclear how the qafilabashi documented the nomads' arati payments for the increasingly textually inclined Durrani state, but if other tax-payment practices serve as an interpretive guide, it is likely that the qafilabashi issued receipts to the nomads and that a munshi recorded those payments in a challan.

43Commodities transported from India destined for Durrani state consumption in Kabul were granted tax-free status by the British during their passage through the Khaibar. This policy was one tactic in a larger strategy to induce a Khaibar routing that allowed colonial authorities to monitor the Indian and European goods Abd al-Rahman purchased and imported, especially those commodities obtained through the redistribution of subsidy money. Although it was not feasible for him to physically inspect each camel load, the darogha was responsible for validating all cargo's legitimate conformity with the requisite criteria for taxless passage through the Khaibar. Like many of the arrangements between the British and their client Abd al-Rahman, the tax-free routing of Durrani state goods through the Khaibar became a contested issue after the agreement was made. Not surprisingly, the main area of contention that developed in this regard surrounded which goods were in fact eligible for tax-free conveyance. The original agreement conceptualized goods destined for Abd al-Rahman's personal consumption to be Durrani state property and therefore eligible for tax-free passage through the Khaibar. From the British perspective, especially insofar as the Khaibar tolls were concerned, Abd al-Rahman's commodities monopolies contributed to the blurring of already leniently vague boundaries between personal, state, and public consumption of Indian and European goods in Afghanistan. Certain items were particularly problematic for the colonial adjudicators of the material status and taxability of commercial goods routed through the Khaibar that were claimed and textually (re-) appropriated by Abd al-Rahman and his officials.

44Abd al-Rahman's import of Indian shakar/shakarti/shakararti or sugar is one example among the many disputes between British and Durrani officials regarding the taxability and textual representation of commercial traffic through the Khaibar. Between February and April 1895, the British darogha at Jamrud, Gajju Mall, notified his superiors of the attempted passage of 856 camel loads of sugar weighing over 6.5 tons.58 A pass from the Durrani qafilabashi in Peshawar had to be presented by the Afghan nomad traders to the British darogha at Jamrud for their camels to be received there. The qafilabashi arranged for the nomads to transport as much state property as possible, and the qafilabashi passes and receipts they presented at Jamrud were designed to indicate the tax-free status of the nomads' cargo to the darogha stationed there. The darogha was responsible for registering these camels as carrying tax-free goods in colonial ledgers containing Khaibar toll-payment records. The Rs. 1,712 in Khaibar tolls represented by the sugar caravans was a substantial sum that piqued the darogha's interest, especially when considered against other categories of taxable and tax-exempt goods in the account books that he managed.59

45The tax-free passage of that volume of sugar through the Khaibar was questionable on a number of counts. First, during the three months in question the British Agent in Kabul reported to his superiors in India that Abd al-Rahman had recently taken steps to monopolize the sugar trade in Afghanistan.60 Colonial authorities already believed that Abd al-Rahman's trading monopolies transgressed the realm of legitimate state intervention in the regional economy, and British policy was to impose Khaibar tolls on any and every commodity transported from India for trade or resale in Afghanistan. This policy applied to Abd al-Rahman's personal and Durrani state property, and the actions of the Jamrud darogha in response to the new variables in the trans-border sugar trade were manifestations of a more encompassing colonial policy. During the same three-month period in early 1895 colonial officials in Peshawar observed that Abd al-Rahman instructed his commercial agent in Karachi to make large purchases of sugar and secure arrangements with the Peshawar qafilabashi for its transportation to Kabul through the Khaibar.61 Gajju Mall the Jamrud darogha sought confirmation from other Durrani officials in Peshawar that the sugar was in fact destined and bona fide for Durrani state consumption and not another object caught in the growing web of Abd al-Rahman's trading monopolies. Although he received a certificate from Abd al-Rahman's almond agent attesting to the necessary features of the sugar from the perspective of the Durrani state, the badami's certificates were "not to be trusted," according to British officials in Peshawar.62

46The Durrani state qafilabashi in Peshawar during the sugar episode was Rustam Ali. Rustam Ali reported to the chief qafilabashi in Kabul, a post then likely held by Mullah Wais al-Din. Mullah Wais al-Din appointed a Peshawri munshi or secretary who physically handled the challan or register book that Rustam Ali was politically responsible for. The munshi during the sugar dispute of early 1895 was Tilla Muhammad, who apparently had a long tenure in that post because he served not only Rustam Ali, but also the three previous Durrani qafilabashis in Peshawar. It was noted earlier that a qafilabashi fee of Rs. 2 and arati tax of Rs. 1 was charged on all camels collecting at Jamrud for the tax-free conveyance of Durrani state merchandise through the Khaibar. In addition to those fees, Rustam Ali and Tilla Muhammad were known to extract a further Rs. 2.6, the former receiving Rs. 2 and the latter Rs. .6, on the same textually conscripted camels.

47At Jamrud, two unequal states dueled over the taxes associated with the interregional nomadic tribal trade. Using a system of passes, receipts, and vouchers the qafilabashi and his munshi wrote various forms of nomadic trade taxes into the Durrani state's expanding monopoly-based fiscal structure, and these fees were in fact collected from the nomads. However, a more determining and relatively stable structure of Anglo-Durrani political relations allowed for Abd al-Rahman's economically constrictive monopolies to be executed even in British India. This arrangement resulted in the Jamrud darogha often only inscribing in colonial record books the potential transit taxes due from the nomads for their textually coerced commercial traversing of the Khaibar, and the sugar episode indicates the British did not attempt to collect many of these fees from the nomads. Competing trade documents prompted tangible social interaction between state functionaries such as the Peshawar qafilabashi and the Jamrud darogha, and between each of those officials and the nomads, as documents from 1896 indicate. These records refer to the qafilabashi's generalized interference in the darogha's activities by "acting as if the whole place (Jamrud) belonged to him (the qafilabashi)," the qafilabashi causing a night time commotion at Jamrud when the darogha was registering some 700 to 800 camels for the next day's travel, the qafilabashi verbally assaulting Afghan nomads whom he claimed refused to carry Durrani government stores, and his "thrashing the kuchis, imposing double fines and seizing their camels."63

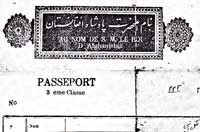

Nomad Passport

Nomad Passport

|

Pasture Dispute Resolution

Pasture Dispute Resolution

|

Provincial Fuel for the State Mint and the Absorption of Social Debt

48The annihilation of the Army of the Indus dealt a severe blow to British political and financial prestige in India. The first Anglo-Afghan war damaged relationships at the upper levels of financing involving hundi transactions between large private banking firms and colonial state treasuries in North India. However, the occupation period resulted in a large infusion of British Indian rupees into the economies Kabul, Qandahar, and eastern Afghanistan.64 The extension of Company capital into this region during the first occupation was relatively successful. One important method of dispersing state coinage into multiple sectors and layers of an economy is to pay local armed forces personnel in that currency, and attention was previously given to Rawlinson's attempt to execute such a maneuver in Qandahar in 1840. Another direct avenue of insinuating one currency into the political space of another is in the context of minting of state coinage. In this regard, although during the occupation a rupee struck in the name of Shuja was the official product of the Kabul mint, that currency was a veneer masking the advance of British Indian coinage. Recycling of British Indian rupees into Shuja's coinage characterized the minting practices in Kabul during the Anglo-Durrani political condominium. The following quote describes the state's hand-minting practices as Trevor witnessed them when he was deputed to revise the Kabul account books in 1841:

[T]he material used in the Cabool coinage is almost entirely Company's Rupees about 22,00,000 of the latter having been melted down last year when the number of Cabool Rupees struck was 27,65,612 and the quantity of bullion brought to the mint equal in weight to only Company's Rupees 85,258. The process of melting and preparing silver for the mint is carried on in the town by contract and the contractors state that their custom is to add lead in the proportion of 40 per cent and that the product of 140 Company's Rupees weight of the mixture and 94½ of pure silver or what is supposed so, and 45 of dross. Again to reduce 94½ Company's Rupees weight of pure silver to the standard of the Cabool Rupee 25 Company's Rupees are added no other alloy is used and the mass weighing 119½ Company's Rupees is coined into Cabool Rupees 147½. The whole expense of the process of melting and purification including labor, charcoal, lead, bone ashes and utensils is defrayed by the dross which becomes the perquisite of the contractor and of which one suwar khanee equal in weight to Company Rupees 3.840 produces 3½ Company Rupees weight of pure silver and 252 ditto of copper and lead mixed in the proportion of five parts of the former to two of the latter the purity of silver received by the contractors is tested by melting a stated portion on a bed of bone ashes in a charcoal fire with lead and it is rejected whenever the loss in the process exceeds a given quantity. That loss seemed to me on witnessing the process to depend not only on the purity of the silver, and on the degree of heat and the length of time it was applied both which are left to the discretion of the operator.65

49At their core, these calculations indicate that during the colonial occupation of Kabul British Indian rupees comprised at least 80 percent of the raw material used in the production of handcrafted state coinage. Hand-minting of Durrani state coinage prevailed in Kabul until 1890 when Abd al-Rahman imported three large minting machines from Europe.66 The European minting machinery greatly expanded the potential production of Durrani state coinage, and Abd al-Rahman accelerated the precedent established earlier in the century of recycling British Indian rupees into Durrani currency.67 The heightened ability to produce state coinage motivated Abd al-Rahman to take extraordinary measures to extract British Indian rupees from his subjects. As an economic institution the mint had profound social consequences, particularly in terms of the centralization of pools of merchant capital dispersed throughout the country in Kabul, a city the British were able to fiscally colonize despite two failed military invasions of it.

50Abd al-Rahman's recoining drive focused on two silver currencies, the British Indian and Durrani rupee, with the former determining the value of the latter. However, other silver coins and a variety of copper and gold-based currencies circulated regularly and widely in Abd al-Rahman's domains.68 As more silver rupees were produced by the minting machines in Kabul the other forms of money found in Afghanistan became increasingly valued through exchanges calculated against the proliferating Durrani state coinage. Because other monies were increasingly defined in relation the Durrani rupee, the effects of the new mint ramified throughout all currency fields, social sectors, and geographic regions of the polity.

51The main external source of British Indian rupee fuel for the Kabul mint was the cash subsidy Abd al-Rahman received, and these outright grants of British rupees were never less than twelve lakhs per year.69 For example, in March 1890 immediately after the arrival of the minting machines in Kabul a subsidy disbursement of 5,00,000 British rupees was transported from Peshawar to the Durrani capital. This transference of subsidy funds was clearly intended for recoining and was likely distributed to the army for broad circulation.70 To acquire the necessary raw material for the new machine mints, Abd al-Rahman also employed the British firm of Martin and Company to import un-coined bulk silver bullion from Europe.71 Whereas the external supply of British Indian rupees and bulk silver had discernible limits, for Abd al-Rahman the domestic sources of British money and other forms of capital were conceptualized as being nearly limitless.

52Abd al-Rahman issued numerous directives that demonstrate his desire to gather and recoin all silver currencies in circulation in Kabul, Qandahar, eastern Afghanistan, and other market settings under his de facto control.72 For example, he prohibited bankers and traders from remitting silver abroad, directed merchants to bring their silver to the Kabul mint, and ordered the public exchange of all previously issued Kabul rupees for his new coin. The export ban and other more direct forms of silver collection comprising the larger reminting initiative targeted bankers, merchants and traders, and, either directly or indirectly, all other participants in the Afghan economy.73

53The measures Abd al-Rahman took to collect silver for recoining in the capital city had important effects on the relationships between Kabul and surrounding markets, districts, and provinces. Qandahar was particularly vulnerable to Abd al-Rahman's silver confiscation tactics as a result of the high volume of merchant capital flowing to and through the city consistent with its longstanding and prominent role in the vibrant long-distance trade between Indian and Iranian markets. In 1885, well before the arrival of the new minting machinery, Abd al-Rahman's appetite for silver to recoin led to seizures of such a magnitude that the British Agent in Qandahar commented: "If this state of things (the confiscations) continues no money will be left with anybody in the whole of Afghanistan, and Government coffers will overflow with money."74

54In January 1889, Abd al-Rahman turned his sights on the commercial brokerage arrangements in Qandahar in order to extract cash for recoining in Kabul. The local community of brokers had been charging merchants a 1 percent commission, but Abd al-Rahman ordered all brokerage in the city to be concentrated under the purview of a single appointee sent from Kabul, a Hindu named Jita, who would collect a 2 percent fee.75 Local merchants viewed this as another form of confiscation by royal decree, so they planned for a week-long export stoppage that would also close the local customs house, but the local Governor dissuaded them from doing so. However, not all local officials were sympathetic to the merchants in Qandahar who were simultaneously enduring searches and seizures of sums ranging from 10,000 to 20,000 rupees by the Chief of Police, Mirza Sultan Muhammad, who regularly trumped up charges against them.76 Another vehicle for Abd al-Rahman's drive to re-mint British Indian rupees into Durrani state currency was the office of sarishtadar or provincial revenue official. Abd al-Rahman appointed the Hindu Diwan Sada Nand to the post of Qandahar sarishtadar in February 1889. Three months later the original and primary focus of the state's confiscatory initiative, the prized British Indian rupees, known locally as kaldar rupees, was again emphasized:

The Kandahar revenue Sarishtadar has prohibited merchants from remitting Indian coins (rupees) toward India. This is because no silver comes to the Kandahar mint from any other country, wherewith to coin Kabuli and Kandahari rupees. The Queen's coin known in Kandahar as Kaldar rupees is melted and coined into Kabuli and Kandahar rupees. The merchants are therefore put to much loss and inconvenience, for they have no merchandise to export at present, and have to remit cash to Bombay and Karachi where only Indian coin is current.77

55The preceding events occurred before the installation of the machine mints in Kabul in 1890. One indication that the new minting machinery almost immediately and most dramatically increased Abd al-Rahman's penchant for silver, especially kaldar, confiscation comes from the British Agent's communiqué from Qandahar dated January 4, 1891. In this correspondence Khan Bahadur Mirza Muhammad Taqi Khan reported a substantial increase in the agricultural tax levied on Durrani state lands, from either one-fourth or one-third of the produce, depending on particular circumstances, to a uniform one-half for all properties.78 State land managers were accountable for remitting a certain preagreed amount of capital just as provincial and district revenue farmers were. Durrani state taxes were not uncommonly paid in some form of cash through the mediation of Hindki bankers and commodities brokers (see earlier). It is fair to deduce that Abd al-Rahman expected substantial kaldar dividends to result from this greatly increased revenue imposition on government lands in Qandahar.

56Greater taxation of government lands can be considered one of the more common and obvious methods of augmenting state revenue, but such a high degree of increase appears unusual and is conspicuously concurrent with the arrival of the new state minting machinery. Immediately after the installation of the machine mints in Kabul Abd al-Rahman called for an array of other state impositions on private capital in Qandahar that can be characterized as extraordinary. A number of harsh measures were taken and bizarre justifications offered in Abd al-Rahman's quest to supply raw material for the surge in coin production resulting from the state's very much-increased minting capacity. While the following quote typifies the kind of arbitrary seizures of capital that took place in Qandahar after the new mints went into service, it is important to appreciate that all kinds of people in all other localities in Afghanistan were subject to similar random confiscatory practices:

Heavy fines are being inflicted and recovered now-a-days for trivial offenses, e.g., a fine of rupees twenty one thousand has been imposed on some villagers, shop keepers, and a camel driver, residents of Deh-i Khwaja, on the ground that the wife of a servant of Sardar Sher Ali Khan, ex-Wali of Kandahar, has gone to Karachi without their knowledge. The camel driver's offense lay in the fact that he hired out his camel to this woman. The villagers were fined for not reporting her departure to the authorities prior to her leaving for Karachi, and the shop keepers were fined because they were related to this woman.79

57The new minting machinery in Kabul precipitated substantive changes in the economy of eastern Afghanistan. Relations between Qandahar and Kabul were acutely affected, with the new Durrani capital city becoming enriched at the expense of the old. On January 18, 1891, the British Newswriter in Qandahar announced the closure of the local mint:

The Governor has received orders from His Highness the Amir to the effect that no money is to be coined in the Kandahar mint in future, and that, for the future, only new coins struck by the machinery lately erected at the headmint in Kabul will be allowed currency in Afghanistan. His Highness, however, has not notified in what way the new coinage is to be introduced, and the old coins withdrawn from circulation. But the people entertain very little hope that the change will be affected without loss being inflicted on the public.80

58Abd al-Rahman clearly recognized the new minting machinery generated profits through the recoining of British Indian rupees and other silver-based coinage into Durrani state or Kabul rupees. In his own rendition of how the new machine mint was fueled, Abd al-Rahman recognized little difference between the recoining of cash grants of British Indian rupees and the ongoing searches for and seizures of silver from his own subjects that are only thinly veiled in the following quote:

Now, however, I am fortunate in possessing coining presses in my mint, made upon the same system as those employed in European countries. . . . The British Government had given me some money coined in the mint at Calcutta; these rupees I ordered to be melted down, and, after 6 per cent. of copper had been added to the alloy, they were re-coined into Kabul rupees (the value of the English rupee is 16 pence, that of the Kabul rupee 12 pence). I also commanded my officials to purchase silver from the country, to melt it down, add a considerable quantity of copper to it, and coin into rupees, in this way making some profit. Moreover, I ordered to be refunded into the Treasury sums of money which, under the former Government, had been borrowed or looted by people, as also other sums that had been entrusted to them by Government for official payments, which sums they had retained in their own hands and used for other purposes. After this general proclamation many people refunded the money they owed and, in order to get the remainder from those who would not pay, I appointed collectors, giving them instructions to force the debtors to give up these moneys. I further appointed accountants, whose duty it was to examine the accounts, and to see that all unpaid taxes were recovered.81

59The new minting machinery in Kabul resulted in the advancement of the British Indian rupee's presence and influence in Afghanistan. The machine-minted Kabul rupee continued to be defined by and subordinate to the British Indian rupee, just as the hand-minted Kabul rupee had been. Overall, the expansion of the British Indian rupee was a prerequisite for the spread of Durrani state coinage in the fiscal colony. Durrani state minting practices during the entire nineteenth century reflect the kind of fundamental and ongoing contradiction pointed out as defining a colonial state's operative mode.82 It served British India well enough to have its currency provide the foundation for an Afghan economy controlled by one of its appointees. However, while recognizing Abd al-Rahman as colonially appointed and funded, it is important to appreciate that the impoverishment of Afghan society had more to do with his actions than British policy. The growing presence of Durrani rupees masked the advance of British Indian coinage, but this was not the source of prevalent economic decline and the related increased need for debt servicing. The origin of Afghanistan's impoverishment lays in Abd al-Rahman's attempt to replace resources controlled by Hindki bankers and brokers with Durrani state capital in a number of economic sectors. The areas where Abd al-Rahman attempted to insinuate Durrani state resources at the expense of Indian merchant capital include cash advances to producers, and larger-scale loans and capital transfer facilities to wholesale merchants and other financiers of the transit trade with India, Iran, and Central Asia.83

60Abd al-Rahman's assessment of the Durrani political economy failed to integrate at least two phenomena. The first was a devaluation of the Durrani currency resulting from its increased production being predicated on the more fervent recycling of a more valuable coin, the British Indian rupee. For Abd al-Rahman, minting money was a goal in and of itself, and he did not seem to fully comprehend the dynamics between the use of a currency and its value in relation to others. The second area of economic miscalculation concerned credit and debt relations and Abd al-Rahman's attempt to assume some of the roles played by Indian bankers and moneylenders in the Afghan economy. In this regard, Abd al-Rahman erred in his belief that replacing Indian bankers' and brokers' capital with Durrani state resources would be profitable.